Today, I will explain in detail how to trade futures on the Bybit exchange.

We will go through the process by actually opening a Bitcoin short position and clarifying each trading term along the way.

1. How to Sign up for Bybit

I have explained in detail how to deposit from a Korean exchange to Bybit in the post below.

Please follow the steps carefully.

Reference link

2. Transfer Funds

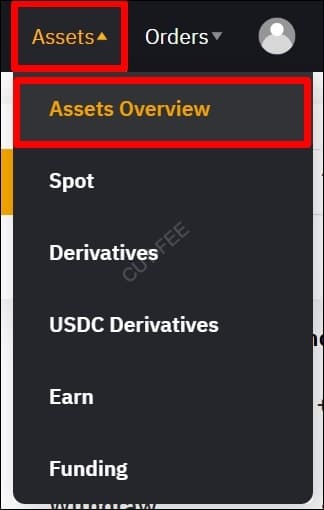

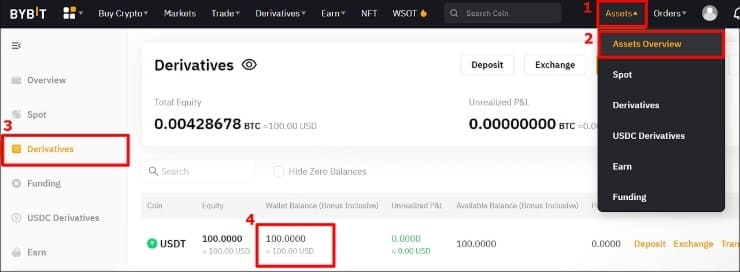

Go to the top menu on the Bybit website and click “Assets” → “Assets Overview.”

This is where you can view your account balances and move funds between different wallets (e.g., Spot, Derivatives, Earn).

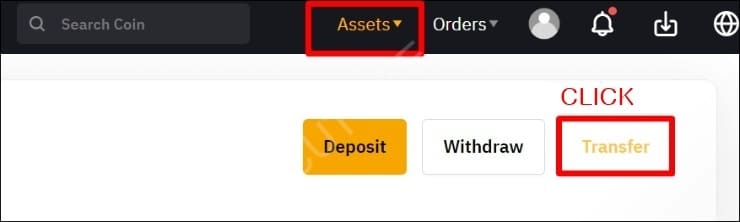

Next, find and click the “Transfer” button.

This allows you to move funds between different wallets within your Bybit account (for example, from Spot to Derivatives).

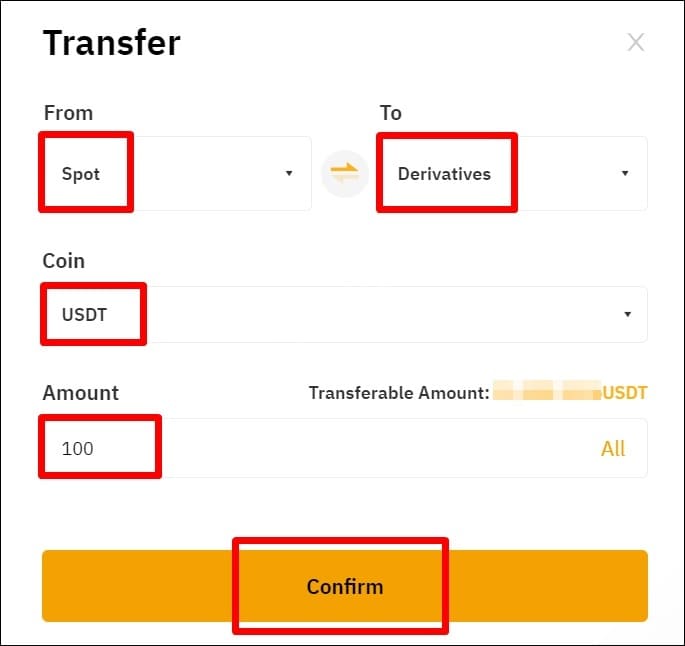

Send USDT from your Spot account to your Derivatives account on Bybit.

In this example, I will transfer 100 USDT.

3. USDT Futures Market Entry

1) Open a Short Position

Now, let’s open a short position in the Bitcoin futures market.

From the top menu, go to Derivatives → USDT Perpetual → BTCUSDT.

Before opening a position, let’s understand the concept of the Funding Rate.

The Funding Rate is a periodic payment exchanged between traders to maintain the balance between long and short positions in the market.

When the funding rate is negative, short traders pay the exchange –0.014% of their position size, while long traders receive the same percentage (+0.014%) from the exchange.

When the funding rate is positive, the situation is reversed — longs pay, and shorts receive.

Select Isolated mode, then set Long 3x and Short 3x leverage.

Choose Market (for instant execution), check Order by Qty, set the quantity to 100%, and click Open Short.

When opening your first position, it’s best to use Isolated mode, since your liquidation price remains fixed and won’t affect the rest of your account balance.

- Isolated: When you open a position, the margin is fixed. Unless you manually add or remove margin using the “Add/Remove Margin” button, the liquidation price will not change.

- Cross: The position uses the entire balance of your futures wallet as margin. The liquidation price changes continuously whenever you add or withdraw funds from your wallet.

- Limit: Works the same as a limit order on Korean exchanges — the order executes only when the price reaches your specified level.

- Market: Works like a market order on Korean exchanges — the order executes immediately at the current market price.

- Order by Qty: Allows you to open a position based on the quantity of contracts.

If you select Order by Cost, the position is opened based on the USDT value instead.

You can use whichever option you find more convenient. - TP/SL:

In the position setup window, click “Sell Short with TP/SL” to expand the take-profit and stop-loss settings as shown in the image below.

If you are opening a long position, click “Buy Long with TP/SL.”

TP / SL:

TP stands for Take Profit, which simply means your target profit price.

When setting a TP while opening a position, you are essentially instructing the system to submit an order to close your position automatically once the market price reaches a specific level.

For example, if you open a short position at $21,500 and set your take-profit price at $20,092.5, Bybit will only place a market (or limit) close order once the Last Traded Price reaches $20,092.5.

If there’s a strong panic sell, the price might fall below your TP level, meaning you could take profit at an even lower (bettazer) price — though sometimes it might close slightly higher, resulting in less profit.

On the other hand, SL stands for Stop Loss, the opposite of Take Profit.

If the Bitcoin futures price rises and reaches your stop-loss level (e.g., $23,762.5), Bybit will then submit a market (or limit) order to close your position.

Similarly, depending on volatility, you might end up losing slightly less or more than the exact stop-loss price you set.

2) Check Position Status

Scroll down a little and you’ll find the “Position” tab.

This section displays all your active positions, including key details such as entry price, quantity, leverage, liquidation price, unrealized profit/loss (PnL), and margin used.

- BTCUSDT Isolated 3.00x:

This means you opened a Bitcoin futures position using USDT as collateral, in Isolated mode, with 3x leverage. - Qty (Position Size):

Indicates the size of your position — for example, –0.013 BTC ($286).

The negative sign represents a short position. - Entry Price:

The average price at which your position was opened. - Mark Price:

Represents the current market price, and if it reaches your liquidation price, the position is automatically closed, resulting in the loss of all margin.

It differs slightly from the actual execution price in the order book.

The Index Price used in the formula is calculated based on the average spot prices from major exchanges.

Formula:

Mark Price = Index Price × (1 + Funding Basis)

Funding Basis = Current Funding Rate × (Time Until Next Funding / Funding Interval)

5. Liq. Price (Liquidation Price):

The price at which your position will be forcibly closed when the Mark Price reaches it.

6. Position Margin:

This is your collateral amount.

Click the pencil icon to manually add or remove USDT:

- Adding margin moves your liquidation price farther away (reduces risk).

- Removing margin moves it closer (increases risk).

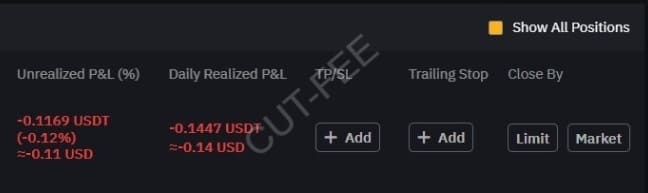

7. Unrealized P&L:

Shows your current profit or loss on the open position — for example, –0.1169 USDT means you’re at a loss, and –0.12% represents your loss rate.

3) Close the Short Position

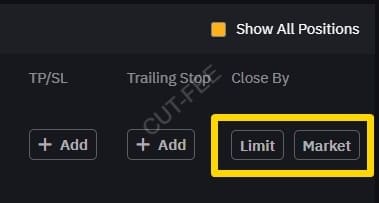

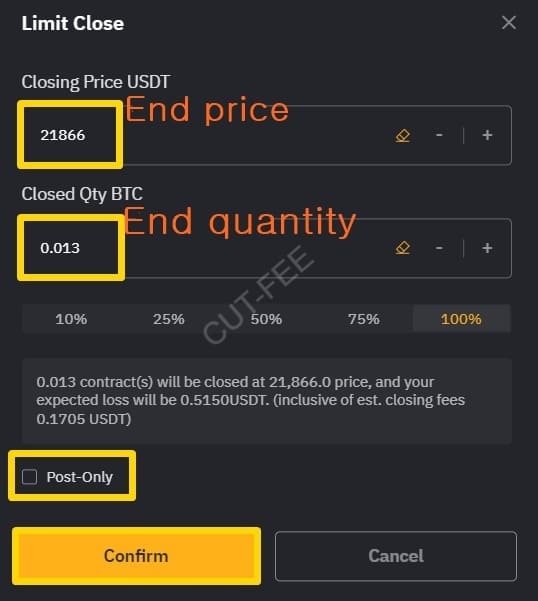

On the far right side of your open position, locate the section labeled “Close By.”

Click “Limit” (Limit Close) underneath it.

This allows you to set a specific price at which you want to close your short position.

Once the market reaches that price, your position will automatically be closed at the preset limit level.

Enter the Closing Price and Closed Qty BTC, then click “Confirm.”

Your order will be submitted — this works the same way as a limit close on Korean exchanges.

4. Entering the Inverse Futures (1x Short) Market

This refers to trading futures using volatile assets such as BTC or ETH as collateral, instead of stablecoins like USDT.

The Inverse futures market is mainly used for:

Hedging existing spot holdings

Funding rate trading strategies.

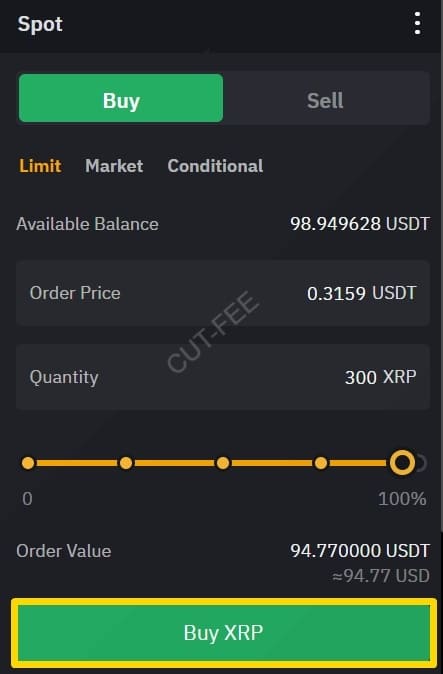

To trade in the XRP Inverse market, first purchase XRP in the spot market.

In the top search bar, type “XRP/USDT”, then select “XRP/USDT Spot.”

Let’s purchase about 300 XRP to use as collateral.

Enter the quantity, then click “Buy XRP.”

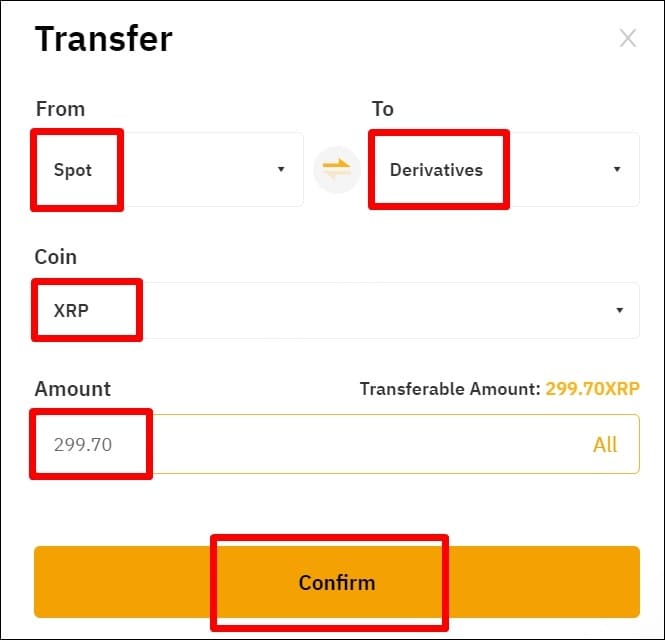

From the top-right menu, go to “Assets” → “Assets Overview” → “Transfer.”

This will open the transfer window where you can move your purchased XRP from the Spot Wallet to the Derivatives (Inverse Futures) wallet to use it as collateral.

Transfer 299.7 XRP from your Spot Wallet to your Derivatives (Inverse Futures) account. You initially bought 300 XRP, but 0.3 XRP was deducted as a trading fee.

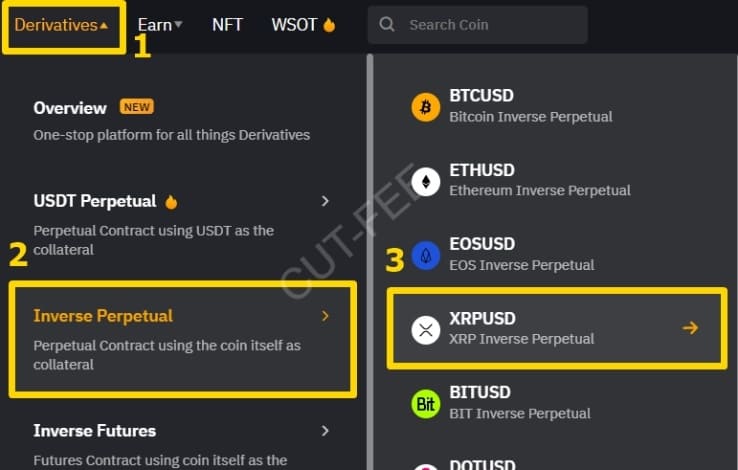

Go to the top menu and click Derivatives → Inverse Perpetual → “XRPUSD.”

Set Isolated mode with 1x leverage, select Market, set the quantity to 100%, and click Sell / Short.

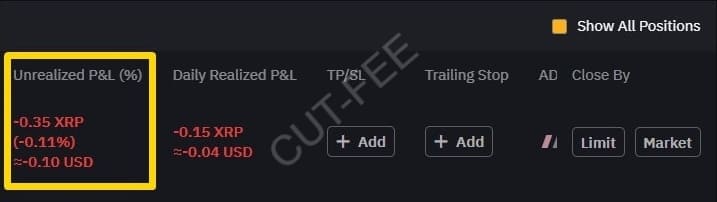

Scroll down, and you’ll see your open position displayed as shown below. I’ll explain only the additional elements that differ from the USDT market.

- Liq. Price ($31.1426): The liquidation price is this high because you opened a 1x short position using spot XRP as collateral. In this setup, if the price rises, your spot position gains while your short position loses; if the price falls, the opposite happens — spot loses, short gains, keeping your total asset value roughly balanced. For more details, refer to the section “COIN-M Market Hedging / Funding Rate Strategy” in the link below.

- Unrealized P&L: In the Inverse market, your collateral asset (XRP) quantity increases or decreases.

If you short and the price rises, your XRP amount decreases.

If the price falls, your XRP amount increases.

This often confuses users because, unlike USDT-margined futures that calculate profit and loss in USDT, Inverse futures adjust the collateral asset quantity instead.

Now, click Market to close the position.

This concludes the post on how to trade futures on Bybit.

Bybit Fee Discount Sign-Up Link

▷ Sign-Up Benefit: 20% Trading Fee Discount

▷ Referral Code: YVDN87K (Must be entered manually if you sign up via the app or website without using the discount link)

Tags -

Posts Tagged with Binance

How to Place a Short Position on Bybit Futures Trading

Cut-Fee

We provide a wide range of information related to cryptocurrencies, including exchange introductions and sign-up guides, as well as detailed instructions on how to use exchanges such as Binance, OKX, Bybit, and Bitget, covering registration, deposits and withdrawals, and trading methods.

View All Categories

Notice

Facebook | Twitter

Recent Comments