Let’s talk about Bitget copy trading. I’ll share my thoughts on how to choose the right trader, what copy trading actually is, and what risks are involved.

The reason why automated trading and machine learning systems keep being developed stems from people’s desire to earn money easily and without stress. Bitget has tapped into this psychological need very effectively. In fact, copy trading has played a major role in helping Bitget climb into the top ten global futures exchanges.

However, many people suffer losses simply because they use the system without fully understanding it — and unfortunately, such cases are rarely discussed or shared openly. That’s why I decided to write this post.

How to Choose Good Traders

1. Finding Traders with a Healthy Track Record

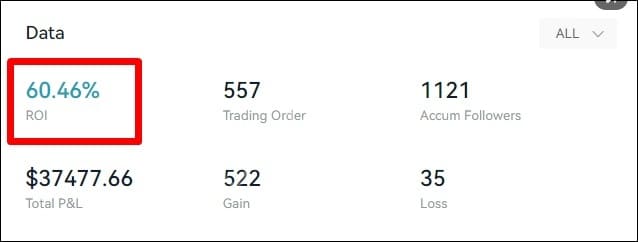

I randomly selected a trader’s profile photo as an example. Since their profit rate and win rate both look decent, let’s go ahead and check their trade history for a closer look.

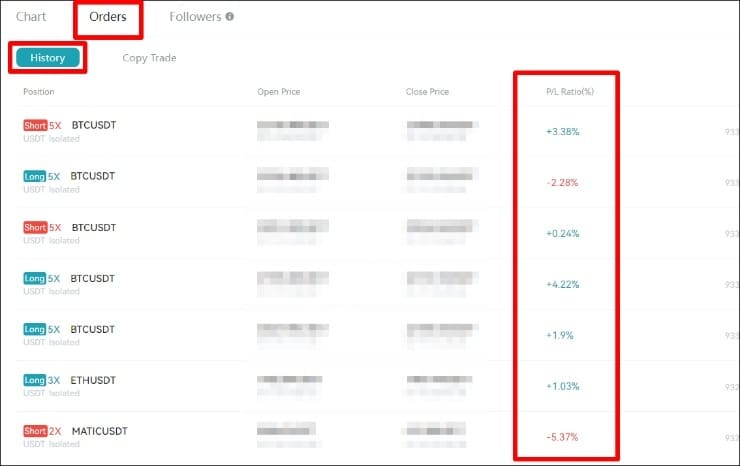

If you look at the P/L section under the “Orders” → “History” tab, you can see both profits (in blue) and losses (in red).

Despite that, the trader’s overall profit rate and total earnings remain positive, which indicates that their winning trades outweigh their losing ones — a good sign of balanced, sustainable trading performance.

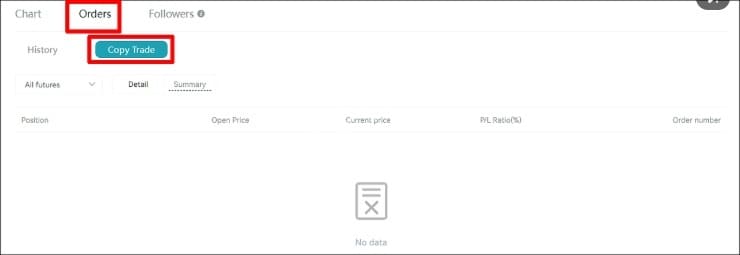

And if you check the “Copy Trade (Current Copy Trading Orders)” tab, it looks clean — there aren’t a series of open trades showing large unrealized losses.

(Of course, depending on the trader’s strategy, having one or two strategically held positions can be perfectly reasonable.)

Even WonYotti, who reportedly earned hundreds of billions, never had a 100% win rate — so it’s completely normal to see some negative trades in between. In fact, this trader’s performance looks quite strong overall. Compared to copy traders who post thousands of percent in returns while holding multiple losing positions in the “Copy Trade (Current Copy Trading Orders)” tab, this person is likely a much more skilled and genuine trader.

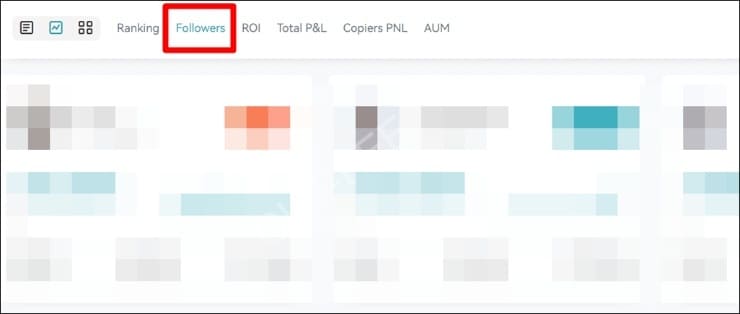

2. Searching by Follower P/L

In the search tab, try sorting or filtering by Follower P/L. Since most of you reading this are followers, it doesn’t matter how impressive a trader’s overall profit percentage looks — if their followers are losing money, it’s meaningless.

Of course, factors like multiple accounts or data discrepancies might prevent this metric from being 100% accurate, but it still serves as a solid first-level indicator for evaluating a trader’s real-world performance.

Bitget copy trading can be beneficial when used wisely, but if you hand over your assets without understanding how it works, your balance can quickly approach zero.

In reality, I’ve met people who became wealthy through their own trading, but I’ve never personally seen anyone who got rich purely through copy trading.

Therefore, I recommend managing your main capital through direct trading — by studying economic trends and chart patterns — and using only a small portion of your funds for copy trading, purely for fun or experimentation.

Disadvantages and Risks of Copy Trading

1. Profit Rate Manipulation

The image below shows the performance of Copy Trader A — an astonishing 3,400% return. At first glance, it might look like investing ten million won could have turned into several hundred million.

However, there’s a hidden trap behind these numbers.

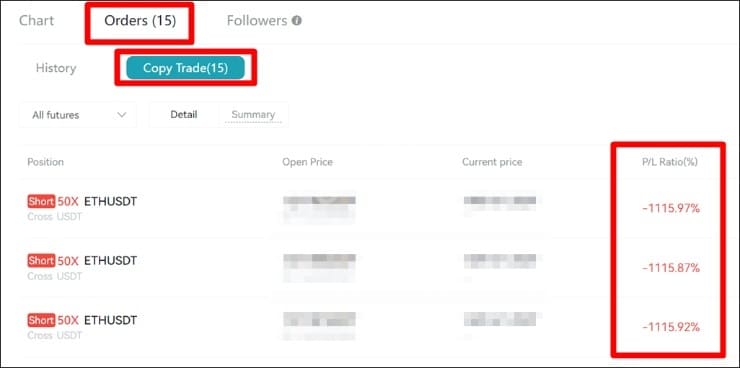

⚠️ If you look at the “Copy Trade (Current Copy Trading Orders)” tab, you’ll see a long list of open positions that haven’t been closed yet. I’m only showing the first page here, but pages two and three are also full of negative positions.

That flashy 3,400% profit rate only includes closed trades, which means it completely ignores all the current losing ones. As a result, even if the trader’s total balance is actually in the red, their profile still appears to be highly profitable.

This is a deceptive presentation of performance — something you need to watch out for carefully.

2. Hiding Follower Profit Rates

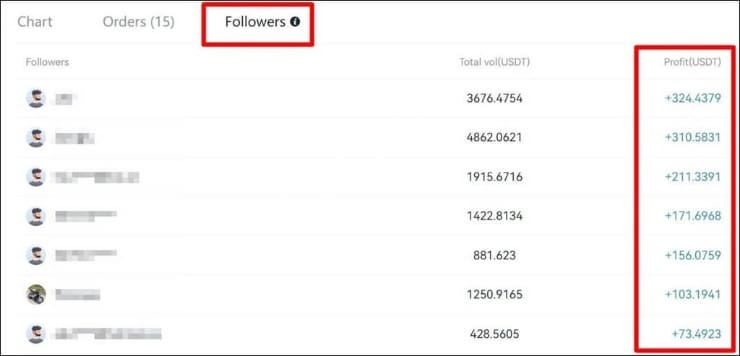

Here’s another screenshot — this time showing the profit rates of Copy Trader A’s followers. Even though I’m only displaying the first page, scrolling all the way to the last one reveals that not a single follower shows a loss.

Of course, it’s theoretically possible for all followers to be profitable, but given that everyone starts copying at different times and price levels, such uniform profitability looks highly suspicious. ^^;;

This usually indicates that follower P/L data might be filtered, hidden, or selectively displayed to make the trader appear more successful than they really are.

If you click the “i” icon next to the follower list, you’ll notice it says that only the top 50 followers are displayed.

This means that if a trader has 70 followers — and 50 are profitable while the remaining 20 are in the red — only those 50 profitable ones will appear.

Also, because Bitget currently allows copy trading without KYC verification, a trader could theoretically create multiple fake accounts using different emails. By following their own profile with these accounts (without even depositing funds), they can hide losing followers and artificially inflate their follower P/L statistics.

Therefore, this is a manipulation risk you should be aware of and treat with caution.

3. Follower Removal

Thank you for reading this long post.

Have a great day, and may your trades be profitable.

Bitget Discount Sign-Up Link

▷ Sign-Up Benefit: 20% Trading Fee Discount

▷ Referral Code: U76H7BKG (Must be entered manually if you sign up via the app or website without using the discount link)

Tags -

Posts Tagged with Binance

How to Choose Good Traders for Bitget Copy Trading and Understand the Disadvantages and Risks

Cut-Fee

We provide a wide range of information related to cryptocurrencies, including exchange introductions and sign-up guides, as well as detailed instructions on how to use exchanges such as Binance, OKX, Bybit, and Bitget, covering registration, deposits and withdrawals, and trading methods.

View All Categories

Notice

Facebook | Twitter

Recent Comments